Differences in Vehicle Insurance between Thailand and your home country | 5 Things you need to know!

AA Insurance Brokers is more than happy to guide you through the maze of Vehicle Insurance options, their benefits, both advantages and disadvantages and to help you select the right cover for your personal situation. Most of us question some Vehicle Insurance rules in Thailand. Below an explanation about some of these rules.

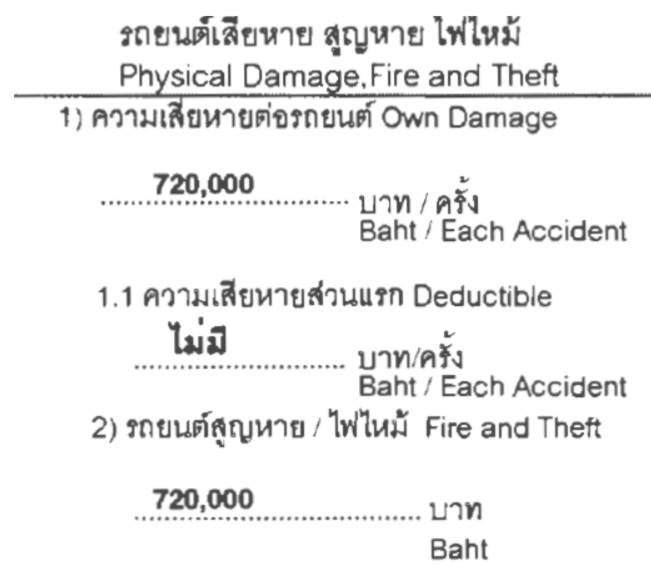

1. Why is the Sum Insured of my Vehicle lower than the actual value?

In your Policy you will find the Sum Insured of your Vehicle. You may notice this amount is lower than the actual vehicle’s value i.e. the Sum Insured is 80 to 85 % of the market value. The main reason for this is that in cases of a total loss or Theft the Insurer will pay the stated amount on the Policy in full - not only on Day 1 of the Policy Year but also on Day 365 where the value is lower due to depreciation.

2. Do I get a replacement vehicle when mine is in repair?

Normally you will not receive a replacement vehicle while your vehicle is under repair. From 2 Years ago you can however claim Loss of Use from the Insurer of the other Party when the other Party was at fault at the rate of 500 baht a day for a sedan (as an example). This needs to be claimed by the vehicle Owner directly from the insurance company of the other party. This requires paperwork but a good Broker will assist you with this.

3. What is the difference between dealer and contract garage?

There are two types of policies available:

1.

Policy based on Dealer Garage. With Dealer policies you can take your vehicle to the official Dealer for repairs. This is more expensive than a Policy with a Contract Garage and is usually an option available until the Vehicle is 5 Years old. In general this is advisable as usually Dealers deliver a higher quality repair and tend to be faster with the repairs.

2.

Policy based on Contract Garage. With Contract Policies, you are not allowed to take the Vehicle to the official dealer (unless you pay the difference between Dealer and Contract cost of the repair yourself). You will be given a list of approved Garages that has a contract with your insurance company.

4. What are the Insurance Requirements by Thai Law?

The only Insurance every Vehicle must have by Law is the CTPL (Compulsory Third Party Liability). As an example, the Policy is 645.21 baht per Year for a sedan. Cheap, but it only covers very limited amounts for bodily injury/death. Property damage is not covered under the Compulsory. All other insurance options (First, Second, Third Class, 2 + 1 etc.) are voluntary. It is not advisable to drive a Car without any extra insurance.

5. Do I receive No Claim Discount?

Normally you will receive a No Claim Discount as follows:

After 1 Year 20 %

After 2 Years 30 %

After 3 Years 40 %

After 5 Years 50 %

Note 1: This Discount only applies to the ‘base’ premium. The Policy premium is made up of several components and the Discount is not calculated over every component.

Note 2: Contrary to what we are used to in other countries, the No Claim Discount belongs to the Vehicle and not to the owner. If you buy a new Vehicle, you will automatically start at 0 % No Claim Discount (except if under certain circumstances).

Isn't it more cost effective to buy Vehicle Insurance directly from an insurance company?

No, whether you go to the Insurance Company directly or obtain your Insurance through us, the premiums are the same. In fact, because of our purchasing power it is even possible to obtain Vehicle Insurance with lower rates from us. Besides that, if you go to an insurance company directly you will only have 1 choice. We can offer you a wide range of options from all insurance companies and have the ability to compare all options available. Another major (and very important) difference is that we are always working on your behalf, not on behalf of the insurance company.

You can fully count on our Claim Support!